-

Hear from Professor Monica Toft

Learn how Professor Monica Toft is shaping the study of global affairs and diplomacy at Fletcher.

Hear from Prof. Toft -

Explore Fletcher academics in action

Fletcher Features offers insights, innovation, stories and expertise by scholars.

Get global insights -

Get application tips right from the source

Learn tips, tricks, and behind-the-scenes insights on applying to Fletcher from our admissions counselors.

Hear from Admissions -

Research that the world is talking about

Stay up to date on the latest research, innovation, and thought leadership from our newsroom.

Stay informed -

Meet Fletcherites and their stories

Get to know our vibrant community through news stories highlighting faculty, students, and alumni.

Meet Fletcherites -

Forge your future after Fletcher

Watch to see how Fletcher prepares global thinkers for success across industries.

See the impact -

Global insights and expertise, on demand.

Need a global affairs expert for a timely and insightful take? Fletcher faculty are available for media inquiries.

Get in Touch

The US Dollar is (Mostly) Strong. Does it Matter?

Professor of International Affairs Michael W. Klein provides insights on the state on the US dollar and what it means for global markets.

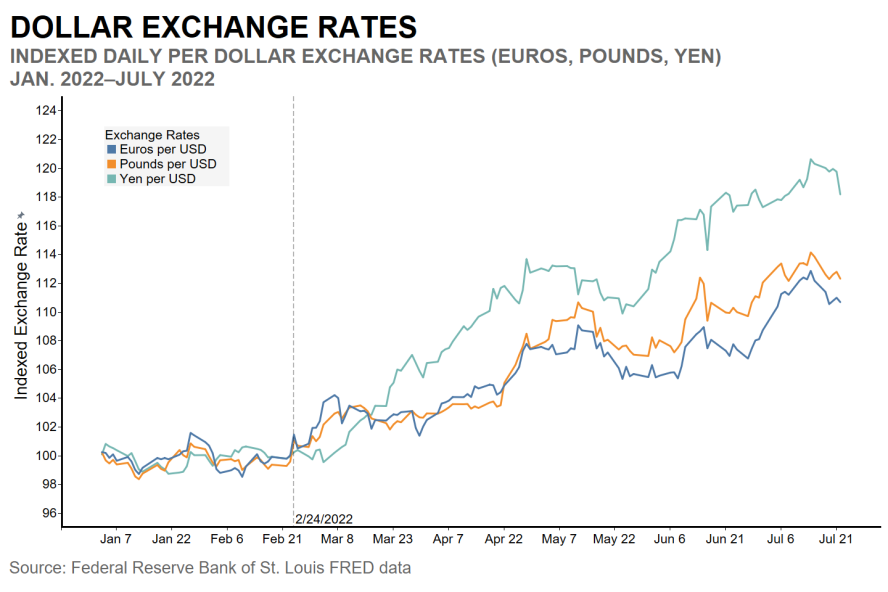

For the first time in almost twenty years, the U.S. dollar recently traded at par with the euro, is at its strongest value against the yen in a quarter century, and a single dollar now buys more British pounds than at any time since the mid-1980s.

Does a strong dollar matter? The simple answer is yes. A strong dollar translates prices of imports into domestic currency, and prices of exports into foreign currency. These prices factor into consumption of goods from abroad, and the ability of companies to sell products in foreign markets.

Michael W. Klein, Professor of International Economic Affairs at The Fletcher School at Tufts University explores the impact of a strong dollar in world markets in his recent EconoFact memo and EconoFact Chats podcast interview with Kathryn Dominguez, Professor of Public Policy and Economics at the University of Michigan. “While Americans can enjoy cheaper vacations to Europe, the downside is that U.S. products are more expensive in world markets, and many emerging market countries may find it more difficult to pay back debts incurred in dollars,” he explained.

One of the reasons for the strong dollar is that, in the wake of the Russian invasion of Ukraine, there was an inflow of capital to the U.S. which raised demand for dollars and, therefore, the price of dollars in terms of euros, yen, pounds and other currencies. “A key reason the dollar has strengthened is because investing in American assets like stocks and bonds has become more attractive relative to assets in other countries,” he noted. “In addition, the Federal Reserve has been raising interest rates to combat inflation and is doing so more aggressively than the European Central Bank, the Bank of England and the Bank of Japan, although the ECB and the BoE are now raising rates, too.”

Interestingly, the Russian ruble, after an initial near-halving of its value against the dollar in the first two weeks after the invasion of Ukraine regained its pre-invasion value by late April. Why has the Russian ruble bucked the trend? “The collapse of the ruble at the outset of the war in Ukraine made imports to Russia much more expensive and signaled the effects of sanctions to its citizens,” he said.

The Russian government raised interest rates and made it even more difficult for its residents to exchange rubles for other currencies, effectively cutting off a source of the ruble's weakness. While the ruble has recovered, the higher interest rates and isolation from world capital markets, as well as other sanctions, are damaging the Russian economy.